The Emergence of Cost-Per-Visitor and What Marketers Need to Know

Location data allows businesses to understand consumer behavior, drive sales, and inform decisions in incredible ways. However, the technology needs for accurate location intelligence are exceedingly complex. Like a Russian doll, there are multiple layers beneath the surface – all working together to collect and interpret massive amounts of data, and determine the best way to deploy intelligence in a dynamic and ever-changing world.

Admittedly, new technologies are inherently complex. Their norms have not been established, and standards compete for consensus. Companies package products in a noble effort to provide a simple interface to promising, powerful, and complex capabilities.

One recent model we’ve taken note of is Cost Per Visit (CPV). On the surface, it seems like a simple way to use location – but when you peel back the layers, there’s a lot that is not immediately clear. The allure of simplicity is concealing some troubling details.

What is Cost Per Visit?

CPV is a new metric that aims to charge advertisers only for new store visits that are driven by media. This structure is meant to increase the efficiency of an advertiser’s spend. However, there are many challenges to overcome before CPV can be reliably used as a transactional metric. For now, if you are evaluating CPV, here are three important things to consider:

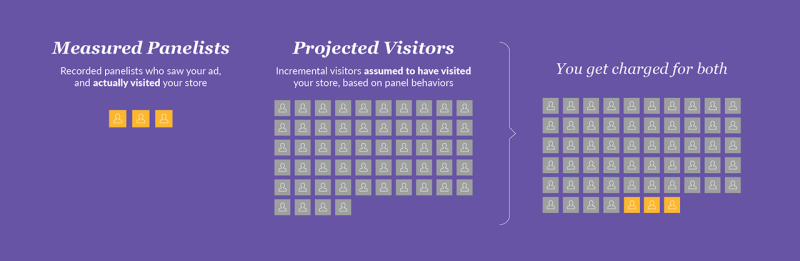

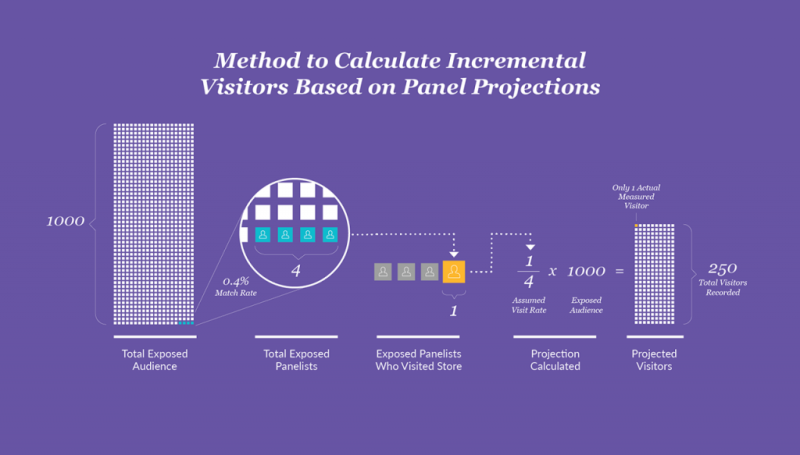

1. Panel projections are used to measure visits – you are not paying for visits, you are paying for projected visits. Current CPV offerings use panel-based projections to validate visitation measurement. While fine for directional insights, limited size panels aren’t ideal when projecting a precise number of visits for locations. This is because panels only measure a very small portion of all visits; the rest of the measured visits (which advertisers are asked to pay for) are assumed to have happened. This all boils down to an alarming fact: advertisers are being charged for projected visits, not actual measured visits.

2. Projections account for a majority of visits a media company is taking credit for – between 99.5% and 99.7% of reported visits are projections, not actual visits. Think about it this way – let’s say 1000 people view your ad. With the standard campaign panel match rates we’ve seen (between 0.3-0.5%), that means about 4 panelists (out of the 1,000) will see your ad. If only 1 out of the 4 panelists visited your store, the other 996 ad viewers (non-panelists) would be assumed to visit at the same rate (25%). This means you would be charged for 250 visitors, even though only 1 was measured as a visitor.

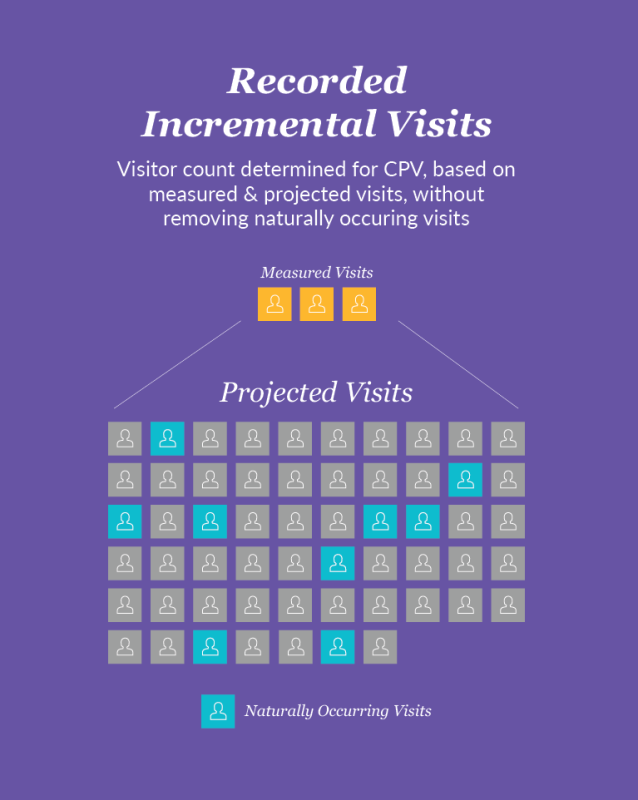

3. The control group methodology used to calculate incremental visits is flawed – which means you will pay for visits which would have occurred anyway!

To account for an audience’s normal visitation behavior (i.e. loyal customers), it is essential to withhold part of your audience from advertising. This is known as a B control group, and is used as a benchmark to measure expected, predictable behavior. True control groups mirror the group who do receive ads as closely as possible – typically down to the DMA and demographic level. In addition, a proper B control group will include previous visitation patterns to isolate the incremental visits driven by your campaign. If someone shops at Kroger every week, it would be disingenuous to credit an advertisement with generating their usual weekly grocery run.

Read our Audience Handbook

Precisely PlaceIQ Syndicated Audience Handbook

Read this handbook and explore real-world audiences to discover new and innovative ways to reach high-value consumers.

Unfortunately, available CPV offerings do not use well planned B control groups. This means they are reporting inflated visitation metrics, and advertisers are being charged for visits that would have occurred normally. Think of it this way – let’s say you target frequent store visitors. A portion of this group would have visited anyways – because that is their typical behavior. Without a proper control group in place to account for this, the advertiser will end up paying for normal visits, instead of just incremental visits.

To summarize; with a CPV model as it exists today, you are paying for projected visits, based upon a panel that measures only 0.3% to 0.5% of your audience. To make matters worse, those visits likely aren’t incremental and we have no way of determining ad-driven visits since a true B control isn’t used.

Think of it this way:

Would you pay Google for 1000 clicks, after 3 clicks occurred?

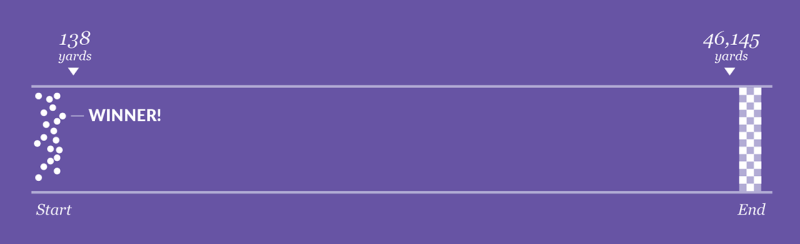

Would you declare the winner of a marathon after 138 yards?

If you answered no to either of these, then CPV probably isn’t for you, as current approaches in-market use the same type of projections.

While one day a proper and accountable CPV system may exist, the structural realities of available data are the natural gating factor. As such, marketers should consider CPV to still be in its primitive stages, with many challenges to address before it can be a reliable metric to transact against. For those testing the waters, it is important to dig deep with your vendor, ask questions, and understand their underlying approach. This will enable you to make the best decision for your campaign, your budget, and your brand.

To learn more, read our Precisely PlaceIQ Syndicated Audience Handbook and explore real-world audiences to discover new and innovative ways to reach high-value consumers.

This post originally appeared as a contributed article on AdAge.com.