Visits Are Up, But Spending is Down as Consumers Budget for Gas

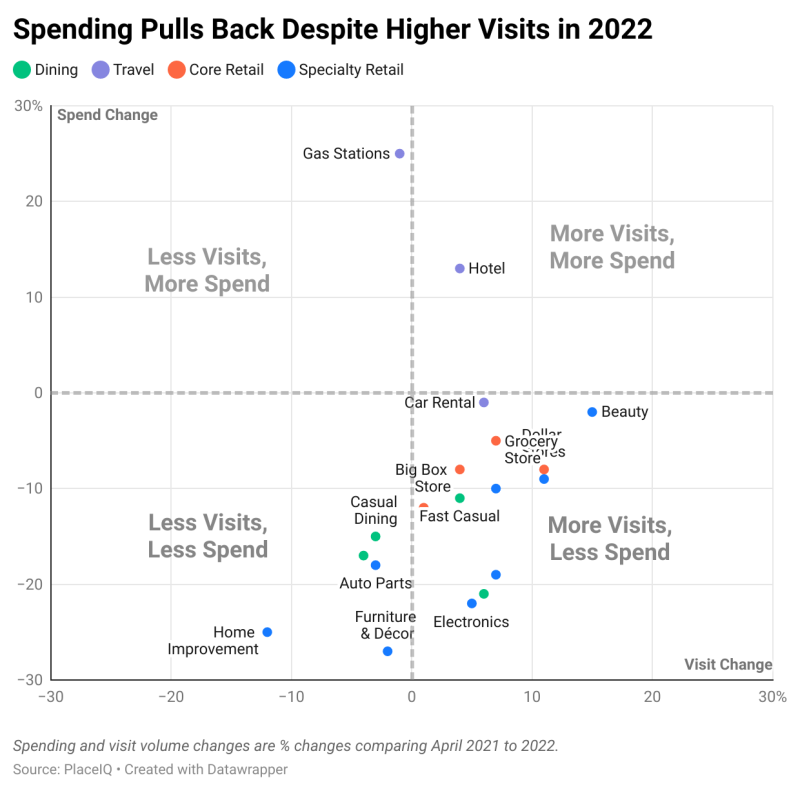

The pandemic isn’t over, but social distancing is no longer the main driver of consumer behavioral change in our data. Higher prices, especially at the pump, are driving down spending in nearly every vertical, despite COVID-weary consumers’ desire to get out of the home. Visits are healthy and travel and entertainment venues are steady.

While COVID cases still continue to rise in many places throughout the US, cases seem less severe than in prior waves. Hospitalization rates are slowly ticking up, but they are far below the levels we saw during the first Omicron and Delta waves. As a result, people are out and about in nearly full force.

However, getting out more doesn’t mean spending more money.

High prices, especially at the gas pump, are forcing consumers to pull back where they can. Spending is down across all retail, despite higher traffic to grocery stores, big box retailers, clothing stores, and more. Recent financial releases from Target, Walmart, Best Buy, and others back up this changing mix of consumer spending – people are trading down for cheaper options, saving where they can, to accommodate high prices at the pump and their desire to go out.

The unique conditions we find ourselves in – with people going out more often (now that they can) yet spending less (to afford the gas they need) – can be tricky to discern with visitation data alone. Thankfully, here at PlaceIQ we have another lens available to us: consumer spending data. By joining spending data to the destinations which we measure for visitation, we can link movement and demand in the real world to understand changing behavior.

Read our Audience Handbook

Precisely PlaceIQ Syndicated Audience Handbook

Read this handbook and explore real-world audiences to discover new and innovative ways to reach high-value consumers.

Let’s look at how the two relate:

There’s two big takeaways here.

First, COVID is no longer the chief driver of consumer behavior. High prices, especially gas prices, are driving change. Businesses can relax a bit when it comes to COVID. Consumers have moved on and are eager to get back to something close to normal. We don’t need to be monitoring cases as much, as we learned in past issues, so long as hospitalizations stay low.

The other big takeaway is that visits are growing while spending is down. People are seeking fun experiences after a couple years of being cooped up. This is why hotels and other travel venues are both up in visits and spend.

Further, COVID darlings like Home Depot and Lowes are dramatically down in visits and spend. After two years of massive momentum, these businesses are stalling. No longer trapped in their houses, people aren’t thinking about changing the paint or fixing a bathroom. They’d rather be outside.

For businesses, this second takeaway has big implications. Yes, spend is down due to everyone making room in their budgets for higher gas prices. But visits are mostly up. People are out there, looking for ways to save while seeking out experiences. Give people a reason to get out of the house and earn their visit.

Tactics for Marketers:

- Marketers should not let their guard down, or competitors will steal their share. Attract new customers by focusing on accessibly priced offerings and experiences now. Include visitors to discount and deal stores in your targeting.

- People are open to new experiences. Conquest audiences who visit other locations in your category and entice them with something new.

- Create habits now as they’re being reestablished — even if spending is low — or risk finding out your customer has established themselves elsewhere when spending does return. Use PlaceIQ’s new Purchase + Audience segments to capture engaged shoppers.

To learn more, read our Precisely PlaceIQ Syndicated Audience Handbook and explore real-world audiences to discover new and innovative ways to reach high-value consumers.