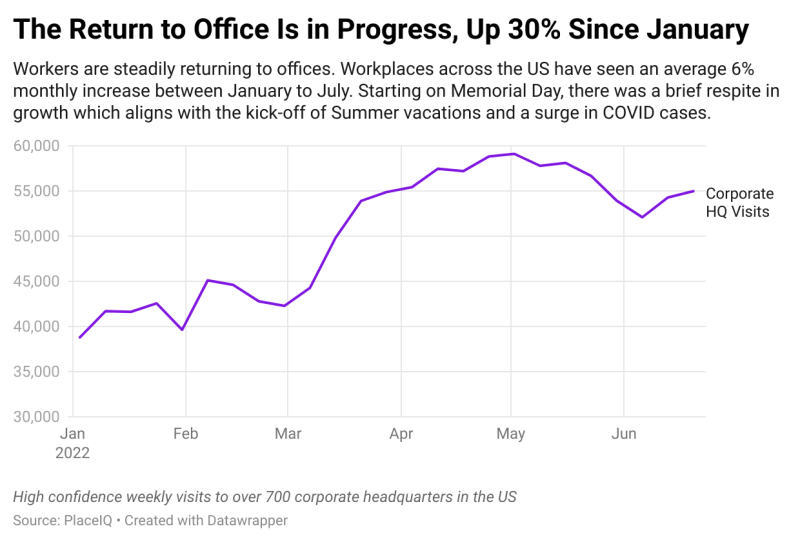

The Return to the Office is in Progress: Traffic to Workplaces is Up 30% Since January

While the debate between remote, on-site, and hybrid work continues to bubble, visitation to offices is steadily tracking upwards.

There’s been a lot of discussion these past few months about the return to the office, working from home, and hybrid scenarios. We’ve read arguments for one way or the other, but the facts on the ground show that a steady, stable return to the workplace is underway. Offices are seeing 30% more traffic than they saw in January, as measured by PlaceIQ’s movement data metrics.

What’s striking to us is the steadiness of the upward march. We see a slight, expected dip when May ends, as Summer vacations kick off and cases ticked up. But otherwise, office traffic has been growing at a steady average of 6% a month. We predict this trend will continue for the foreseeable future.

PlaceIQ is best equipped to measure this change. Here we’re utilizing a unique panel of automotive data to measure visitation and commutes to the top 700 corporate headquarters in the US, across all industries.

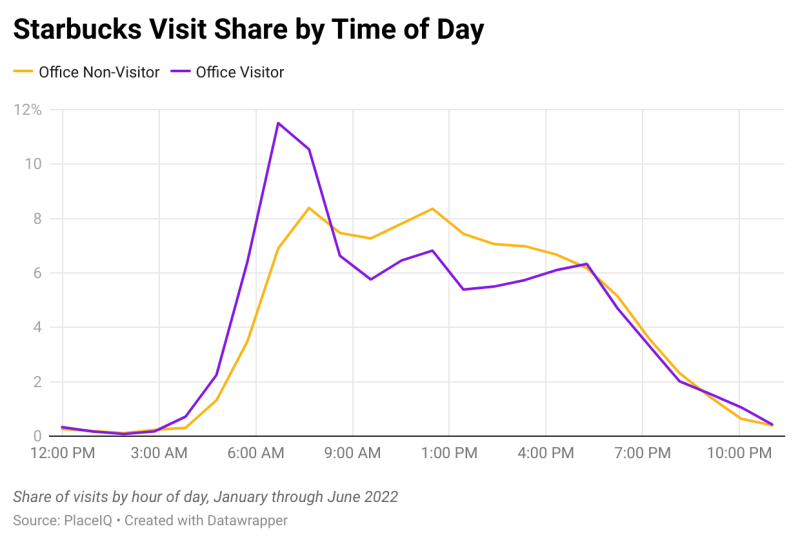

As we explored last time, the return to the pre-COVID activities is driving bright spots of demand in a tight market. The return to the office drove huge gains at business apparel retailers and we’re seeing dramatic knock-on effects at restaurants. If we isolate the segment of consumers who’ve visited workplaces and compare them to those that have not, we can see major shifts in periods of demand at dining venues. For example, here’s Starbucks:

The share of all visitors hitting Starbucks between 6am and 9am is >50% higher among those returning to the office. The morning commute rush is back, shifting traffic volumes dramatically earlier.

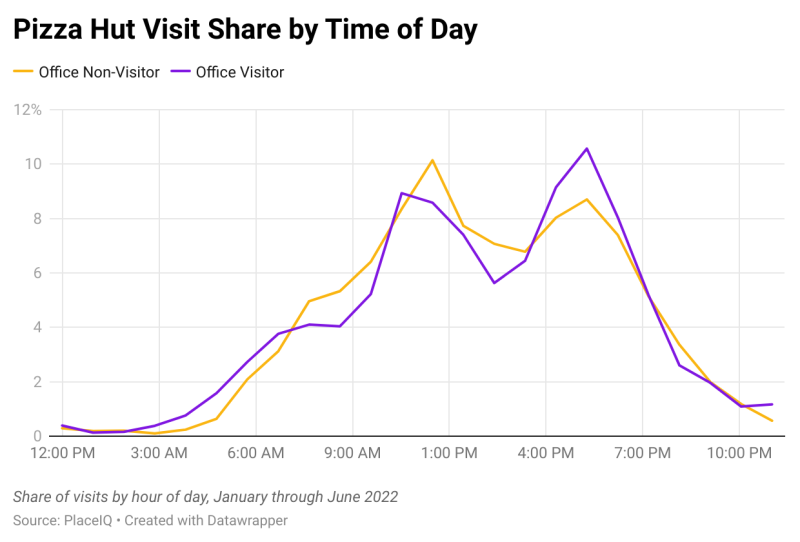

At Pizza Hut, we see the shift towards the commute home:

The 5pm spike is 20% higher among those commuting, who’ve returned to picking up pizza on the way home after a busy day.

During the height of the pandemic, foot traffic shifted towards the mid-afternoon. A late lunch or 3pm coffee break was the dominant occasion, among those working from home. Commute hours were near ghost towns – unless your menu lent itself towards take-out family dining.

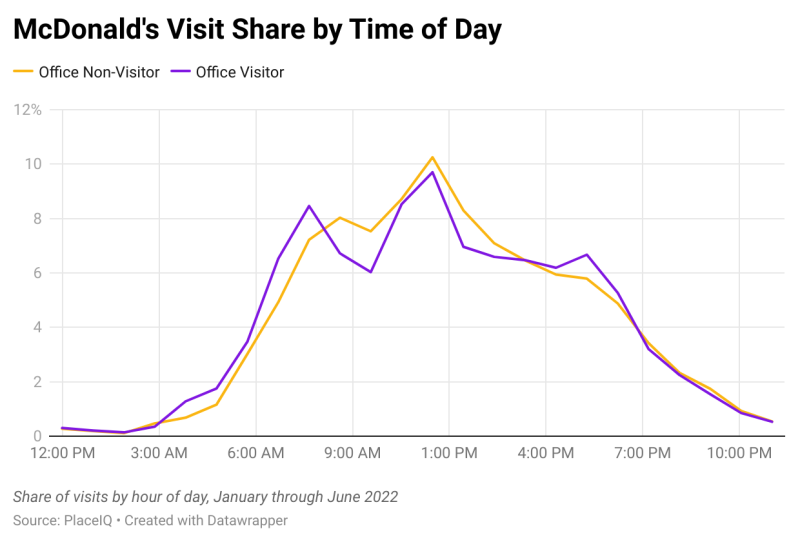

Today, with the return to normal – and in-turn the office – in full swing, we’re seeing the trends revert. We were particularly compelled by the pattern exhibited at McDonald’s:

Product Information

PlaceIQ Movement

Develop smarter marketing strategies and drive real-world consumer actions by using PlaceIQ’s proprietary visitation data to analyze consumer movement, on your own terms.

People who’ve returned to the office exhibit the snappy, structured visitation dictated by commutes and lunch breaks. The near-smooth bell curve distribution of non-office workers has none of this rhythm. With the return to the office, pre-COVID behaviors snap back into place.

For marketers, this steady shift represents a golden opportunity. People are returning to old rhythms and are slowly reestablishing their habits. Savvy advertisers will target those returning to the workplace – using audiences like PlaceIQ’s Recent Office Return or Digital Nomad segments – to influence these new routines before the cement dries, and customers are lost to the competition.

However, act now: the steady return to work is a steadily closing window of opportunity.

Develop smarter marketing strategies and drive real-world consumer actions by using and proprietary visitation data to analyze consumer movement, on your own terms. Read more about our product PlaceIQ Movement.