One Stop Shopping Trips are Gaining Popularity

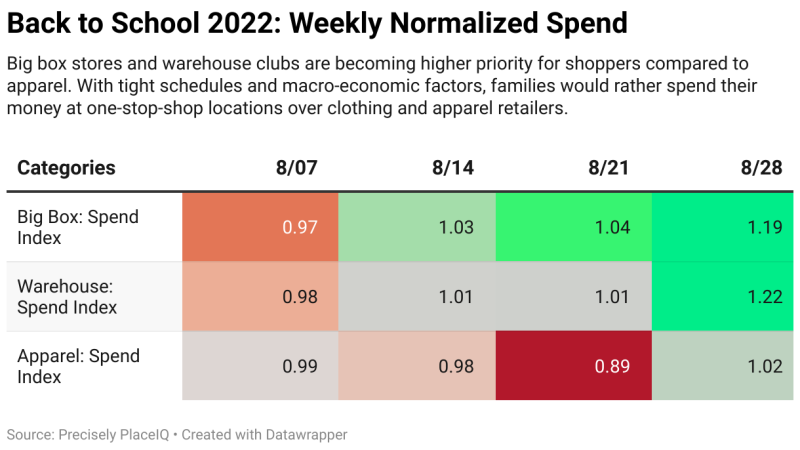

On average, Big Box and wholesale Warehouse Clubs see a 16% higher bump in spend during the core back-to-school period compared to apparel and clothing stores.

With a post-pandemic prime shopping period behind us, we wanted to investigate consumer spending habits, considering the context of reemergence and macroeconomic factors. With the knowledge that people pulled back on shopping through mid-August, we looked at transaction metrics for major back-to-school retailers leading up to the first day of school.

Back-to-school signifies not only children returning to school but also a return to consumers’ typical routines and needs. Warehouse Clubs and Big Box stores saw the highest bump from this change – about 16% in late August. Traditionally, people might shop at various retailers to stock up for back-to-school; however, retail categories like apparel and office supply brands aren’t experiencing the same increases as one-stop shop retailers. With routines becoming stricter and purchasing power decreasing, customers are prioritizing trips to single stores that can cover more of the back-to-school shopping list at a lower cost.

Consumers are prioritizing price. Tighter purchasing habits in combination with inflation is resulting in value spending. This is different from the rebound retail saw earlier this year. At the end of July, we noted that spending surged to business apparel retailers as workers returned to the office; however, back-to-school shopping did not follow this specialty trend.

Read our Audience Handbook

Precisely PlaceIQ Syndicated Audience Handbook

Read this handbook and explore real-world audiences to discover new and innovative ways to reach high-value consumers.

Looking back on this busy shopping period, retail marketers would be smart to message shoppers making purchases at Big Box stores or Warehouse Clubs to bring them back before the Holidays. Reach these shoppers by activating our Purchase-based Audiences, including Back to School Top Spenders, Big Box Purchasers, and Recent Discount Store Shoppers.

To learn more, read our Precisely PlaceIQ Syndicated Audience Handbook and explore real-world audiences to discover new and innovative ways to reach high-value consumers.